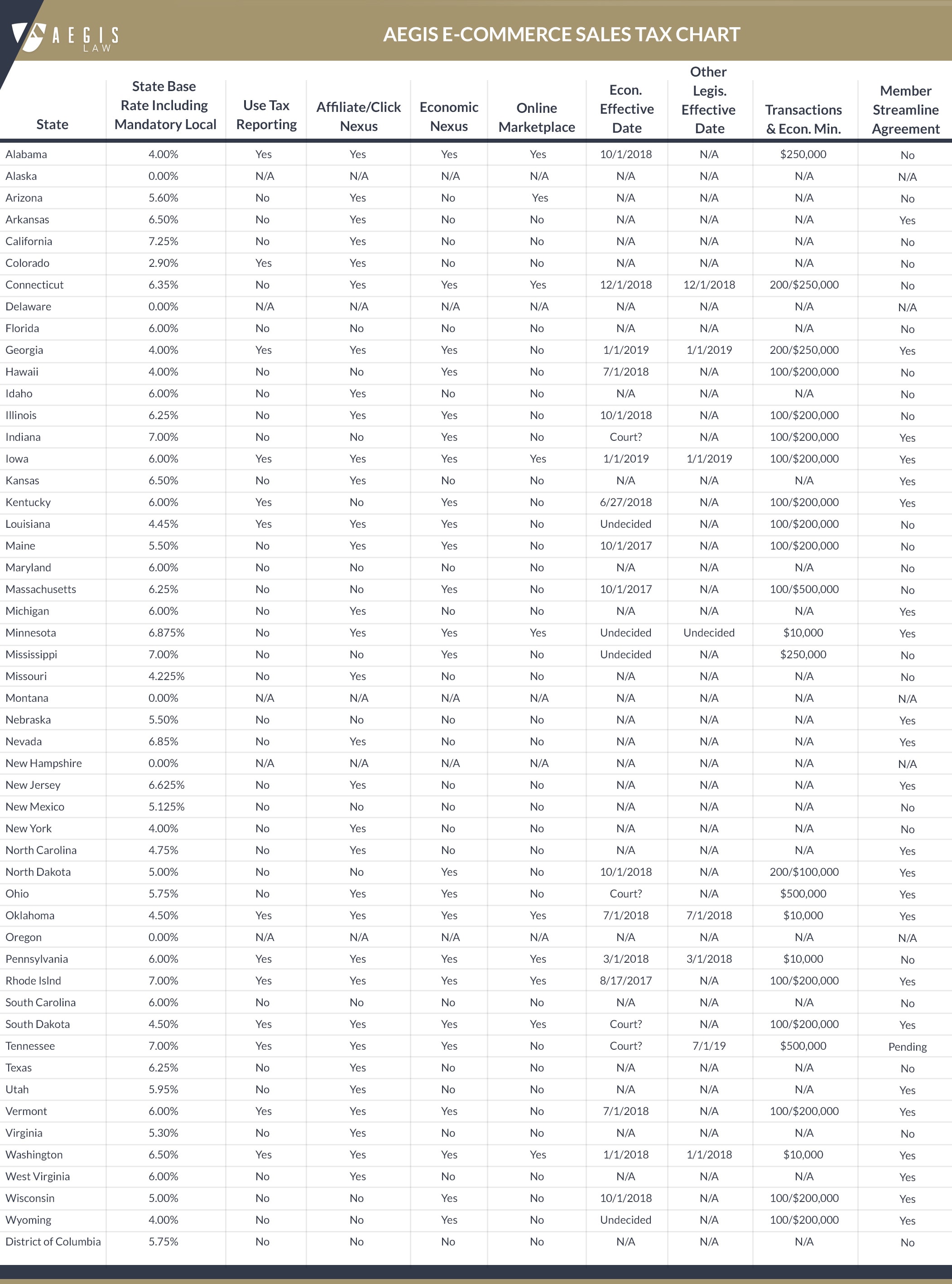

Businesses are now facing multi-state sales and use taxation as a result of the US Supreme Court decision in South Dakota v. Wayfair, Inc., et al. in June. However, state level statutes, regulations and rulings will determine whether and to the extent a given company will be required to collect and remit sales and use taxes to various states, assuming those state laws otherwise comply with the decision. The attached chart and key will give businesses some guidance on current state law requirements for each state and the District of Columbia.

A few caveats here:

First, the chart is current as of August 1, 2018, but this is a rapidly evolving area of the law. Many states have adopted (or are moving towards adopting) statutes similar to the one upheld in the US Supreme Court decision, or have enacted different nexus minimums.

Second, while AEGIS Law has endeavored to verify the accuracy of the chart, we make no guarantees or representations of its accuracy or its application to given kinds of businesses or transactions.

Third, the chart (and this blog) are intended for informational purposes only, and do not

constitute, and may not be relied upon, as specific legal advice.

Please contact your AEGIS Law attorney, Norman S. Newmark, head of the firm’s tax department at nnewmark@aegislaw.com, or Rochelle Friedman Walk, head of the firm’s e-commerce division at rwalk@aegislaw.com, for more information or specific advice.

The choice of a lawyer is an important decision and should not be based solely upon

advertisements.